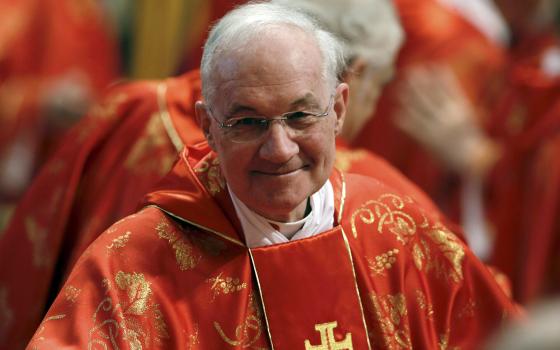

Pope Francis greets Cardinal Giovanni Angelo Becciu, then prefect of the Congregation for Saints' Causes, at the Vatican Dec. 16, 2019. (CNS/Vatican Media)

The Vatican is opening criminal proceedings on July 27 against Giovanni Angelo Becciu, a once-powerful cardinal demoted by Pope Francis last fall, and nine other defendants. They are charged with embezzlement and other crimes linked to a 2013 investment of a purported $240 million in a London real estate venture that kept swallowing money until it went bust, leaving an approximate $415 million Vatican loss.

The trial marks an emboldened turn in Francis' papacy, likely to surpass other forensic dramas in the chain of scandals since "Vatileaks," when Pope Benedict XVI's butler, Paolo Gabriele, went to prison in 2012 for leaking papal documents to an Italian reporter. In that trial, the magistrate barred key evidence from a secret report by three cardinals that could have shed light on who assisted Gabriele.

In the current trial, the prosecution's web work of links among defendants has attacked the leaders of both the Vatican bank (formally, the Institute for the Works of Religion) and the Vatican's wider financial watchdog apparatus.

The trial before a magistrate has no jury. Prosecutions in Western courts rely on a story, a simpler-the-better narrative in proving guilt. This one resembles a police procedural directed by Fellini.

Still, the trial is the sharpest sign of Francis' evolving legal strategy in response to church scandals.

The headquarters of the Institute for the Works of Religion, commonly known as the Vatican bank, with the Apostolic Palace in background (NCR photo/Joshua J. McElwee)

Francis has fashioned a two-pronged approach. As a sovereign monarch, he has engineered major revisions in the Code of Canon Law to hold bishops more accountable for negligence and abuse, bringing the church closer to procedures in Western courts.

Fr. Tom Doyle, a veteran canonist, an inactive Dominican priest and expert witness in cases for clergy abuse survivors, credits Francis' canon law reforms, among which was the removing of the use of strict confidentiality rules in proceedings involving sexual abuse.

The so-called pontifical secret is no longer to apply to any accusations, proceedings or final decisions involving clergy abuse. "It means legitimate requests for church documents in litigation should be respected," said Doyle.

He told NCR: "In some cases I've seen, they're still fighting for documents. Some of the dioceses are still trying to get confidentiality into settlements. Having the pope on your side in a civil pleading helps."

Alternatively, said Doyle: "Francis is in a political system that can stonewall him. The Roman Curia has hidden agendas all over the place; he's managed to cut through that in finding some people he can trust."

Beyond revising the Code of Canon Law, the Vatican City State under Francis is taking a more aggressive role in prosecuting cases within its legal jurisdiction, far more so than under Popes Benedict XVI and John Paul II in the past.

Cardinal Pietro Parolin, Vatican secretary of state, gives a blessing as he celebrates a Mass for the opening of the 92nd judicial year of the Vatican City State court, in the Pauline Chapel at the Vatican March 27. (CNS/Vatican Media)

"The Vatican City State penal code is heavily based on Italian penal law, but it is its own separate system," Nicholas Cafardi, a canon law scholar and former dean of Duquesne University law school, told NCR.

"There is an agreement, based on the 1929 Lateran Pacts, under which the Vatican City State can defer criminal matters that happen inside its territory to the Italian criminal authorities" — or the city state can conduct its own prosecutions, as it is increasingly doing today.

Under the 1929 Lateran Treaty, the Holy See and Italy agreed to coexistence terms as separate countries. Italy paid $92 million for territories once considered the Papal States, granting the 109-acre city state its own jurisdiction, with the option for the pope to request that Italian authorities take over and handle a given legal case.

Historically, popes kept the Italian state at arm's length about the city state's internal affairs. That began to change in 2010, when Benedict, reeling from Vatican bank scandals, approved a financial oversight authority with independent investigators to secure compliance with Moneyval, a Council of Europe monitor to thwart money-laundering and financing terrorists.

The Holy See had to meet higher standards for its bank. In contrast, under John Paul, when Italian authorities went after Archbishop Paul Marcinkus as head of the bank during the mid-1980s, he stayed within the walls of the city state, avoiding Italian authorities who wanted him for questioning on the bank's role in the collapse of Banco Ambrosiano in a money-laundering scandal.

Archbishop Paul Marcinkus, center, is seen with Pope John Paul II in an undated file photo. (CNS/Catholic Press Photo)

Italy finally halted its attempts and allowed Marcinkus to leave for America. He spent his sunset years in Arizona playing golf.

Becciu was sostituto, "substitute," meaning an undersecretary at the Secretariat of State, the Holy See's powerful central office, when he allegedly authorized the office's 2014 investment of $240 million for redevelopment of a vast warehouse in London's upscale Chelsea district. However promising it seemed on paper, funds ran short. To shore up its stake, the Secretariat of State allegedly sought help from the Vatican bank. That alleged request sparked a long investigation that led to the indictments.

"Francis could have indicted Becciu under canon law," said Doyle. "There's not much in the canons on finances; he could have charged Becciu with misuse of office. Francis felt the need for a stronger mechanism. If he gets sentenced to jail, he goes to jail."

The once-trusted Becciu is girding for a fight. Though he was essentially fired from his job as head of the Vatican office responsible for overseeing Catholic sainthood causes and also renounced "the rights connected to the cardinalate," including the right to vote in any possible future conclave, Francis permitted him to remain a cardinal in title.

Cardinal Giovanni Angelo Becciu speaks with journalists during a media conference in Rome Sept. 25, 2020. The cardinal told journalists he was asked by Pope Francis Sept. 24 to resign as prefect of the Congregation for Saints' Causes and renounce the rights associated with being a cardinal due to an embezzlement investigation involving Vatican funds and a charitable organization run by his brother. (CNS/Junno Arocho Esteves)

In November, Becciu filed a defamation lawsuit against the Italian newsweekly L'Espresso for its investigation into financial dealings that included his brothers in other investments.

The lawsuit claims he led "an isolated life" and, wondrously, "could have been a likely candidate for pope at the next conclave."

The Vatican prosecutor (known formally as the promoter of justice) alleges a dense web of alliances around Becciu that includes two laymen who built the Vatican's main financial watchdog agency, formerly known as the Financial Information Authority and by the Italian acronym AIF.

That agency was arguably Benedict's greatest reform. René Brülhart, named its president in 2010, came from the Egmont Group, a network of national financial-intelligence agencies that track financial crimes. Tommaso Di Ruzza became his top assistant as the agency's director.

Brülhart and Di Ruzza plunged into damage control, hammering out rules for accounts and lending subject to new auditing standards that satisfied Moneyval. That was no small feat. The agency steadily forced the bank to close hundreds of suspicious accounts.

Tommaso Di Ruzza, left, then director of the Financial Intelligence Authority, and René Brülhart, then president of the same Vatican office, arrive for a news conference at the Vatican April 28, 2016. (CNS/Paul Haring)

In God's Bankers, a sweeping 2015 history of Vatican finances, Gerald Posner wrote of Brülhart:

As the lay chief of AIF, he could have easily been considered no better than the head of an internal affairs unit in a police department, someone with whom clerics and financial officials were obligated to deal with, but for whom they had no trust or liking. Now they saw Brülhart's AIF role differently. By having someone in charge of financial oversight who understood how best to navigate the labyrinthine rules of the European Union and neighboring Italy, the Vatican may have found someone who could help bring the institution into the modern era.

Brülhart's mastery of EU and Italian banking rules did not equip him for the labyrinthine politics of the Roman Curia.

In 2019, the Vatican auditor general, similar to an inspector-general, raided the AIF offices, seized documents, computers and suspended five employees, including Di Ruzza.

News reports cited the alleged misuse of Peter's Pence, an annual worldwide donation program for Catholics to give directly to the Vatican for the pope's charitable use. (The papacy has a history of using Peter's Pence to stanch Vatican deficits, as I reported in 2011 in Render Unto Rome.)

Reuters' account of the AIF raid pointed to the Secretariat of State's "minority stake in a complex plan to buy the building in London's Chelsea district and convert it into luxury apartments."

Recent Vatican indictments on charges ranging from embezzlement to money laundering and abuse of office stem from investigations into the Vatican purchase of this building at 60 Sloane Avenue in the Chelsea neighborhood in London. (CNS/Tolga Akmen)

Brülhart soon resigned, the architect of Benedict's banking reform in the crosshairs of another Vatican office.

The Vatican's 10-page summary of the 500-page document the prosecutor gave the magistrate for the current trial (akin to the bill of particulars in a U.S. indictment) puts Brülhart and Di Ruzza squarely in the net. The document states:

According to Vatican magistrates, AIF "overlooked the anomalies of the London transaction – of which it had immediately been informed — especially considering the wealth of information acquired as a result of intelligence activity." According to the results of the investigation, Di Ruzza acted in concert with the Secretariat of State. ... The Promoter of Justice "believes that AIF's behavior in the persons of its director and president seriously violated the basic rules governing supervision."

After the July 3 indictment of Becciu, Brülhart, Di Ruzza and seven others, Brülhart told journalists: "I have always carried out my functions and duties with correctness, loyalty and in the exclusive interest of the Holy See and its organs."

He called the indictment against him "a procedural blunder that will be immediately clarified by the organs of Vatican justice as soon as the defense will be able to exercise its rights."

Di Ruzza echoed Brülhart, saying: "I am serene and confident that the truth of the facts and my innocence will emerge and will be clarified soon by the Vatican judicial authorities."

He added: "Institutional financial intelligence activities are at stake, including cooperation with foreign agencies, requiring adequate procedural safeguards not only to protect the right to defense but also the sovereign interests involved."

Advertisement

In accusing the guardians of the gold house of becoming robbers, the Vatican prosecutor set a high bar. In explaining the flow of money, the prosecution erected a halo of innocence over Cardinal Pietro Parolin, the secretary of state, who is alleged by some outlets as having signed off on the London deal.

As the trial begins, speculation is mounting on how long it will take for the prosecution to lay out the expected reams of evidence. Asked about this, Cafardi chuckled: "A three-year trial is typical for Italian courts. You're really not guilty until you're found guilty in the third 'instance,' as they refer to appeals."

Cafardi has a home in Italy and has done consulting work for Vatican offices. "It can take so long getting to the third instance that the statute of limitation can run, unlike in the U.S. where the statute is closed when you're indicted," he said. "These guys will have rights to two levels of appeal after the trial."

"Byzantine is a very fair word," he continued, warming to his subject. "It's one reason American companies think long and hard about investing in Italy. A civil lawsuit can take 10 years. All that time you're waiting for your money. There's also the perception is that it's not fair, justice delayed is justice denied."

Cafardi praises Francis as "one of the most pastoral pontiffs we've had in a long time, helping people, asking questions later."

"In terms of the Vatican bureaucracy, does he have control?" asked the canonist. "One reason Benedict resigned was that he didn't have control. John Paul wasn't concerned about the Curia; he wanted a worldwide pontificate. Francis has a document in the works, restructuring the Curia. The question is whether he can deliver structural changes."

The door to the Vatican's office of the Secretariat of State (NCR photo/Joshua J. McElwee)

The impending trial underscores that challenge. The tearing divisions that turned Benedict's major reform, the watchdog agency, into the target of Vatican prosecution, have effectively gutted it. Francis reorganized the outfit and changed its name to the Supervisory and Financial Information Authority (ASIF) in December 2020.

Given the crooked fiefdoms that once flourished among midlevel Vatican Bank managers, the web of allegations in the Becciu case seem a repeat of the bank's worst excesses. After financial scandals spanning three papacies, why hasn't the Holy See centralized its assets and investments? How many more fiefdoms in the Curia invest?

Speaking to reporters on July 4, Parolin — Becciu's old boss — called the Secretariat of State "the victim" of the financial scandal. Parolin also promised to give testimony, should the court ask him to do so.

"As an institution we believe that we have been damaged from everything that has happened," said the cardinal. "We have to defend our position and our morality."