The U.S. Capitol in Washington on Oct. 16, 2013, during a government shutdown (Stephen Melkisethian/Creative Commons)

The part of tax law that prohibits houses of worship from engaging in explicit political activity will remain intact for now, despite concerns that Republican lawmakers would try to repeal it in the latest massive federal spending bill they released this week.

The more than 60-year-old law, often referred to as the Johnson Amendment, bars churches and other tax-exempt organizations from endorsing political candidates. A group of conservatives — mostly evangelical Christian leaders and a few Republican lawmakers — have advocated for its removal in recent years, and a 2017 bill from the House Appropriations Committee included a provision largely defunding IRS efforts to enforce it.

This year's $1.3 trillion omnibus bill, released by the GOP on Wednesday night (March 21), however, does not include a repeal. Its absence was celebrated by faith leaders and nonprofit groups who advocated against repealing the law, arguing that it protects them from political coercion.

"Those who depend on houses of worship and community nonprofits can breathe a sigh of relief, as concerted efforts to weaken the long-standing law that keeps the 501(c)(3) sector free from partisan campaigning were rebuked yet again," said Amanda Tyler, executive director of the Baptist Joint Committee for Religious Liberty.

"Some hoped they could slip a bad policy change into must-pass legislation, but advocates for keeping nonprofits nonpartisan spoke up and prevailed."

Tim Delaney, president and CEO of the National Council of Nonprofits, echoed Tyler's enthusiasm but warned that repeal efforts will likely continue. "It would be nice to celebrate a long and hard-fought victory, but we cannot afford to relax," he said in a statement.

Advertisement

"Last year prominent politicians and well-funded lobbyists tried to gut the Johnson Amendment through an executive order and five separate bills. Their zeal last year suggests they likely will continue their push to hijack charitable goodwill for their own political ambitions while rewarding their supporters with charitable tax deductions for partisan donations."

Last year's attempts to gut the Johnson Amendment included several efforts to attach a repeal to larger legislation. The GOP-authored tax bill, for example, initially included language that would damage the law. That version was passed by the House of Representatives but removed from the final bill negotiated with the Senate in December.

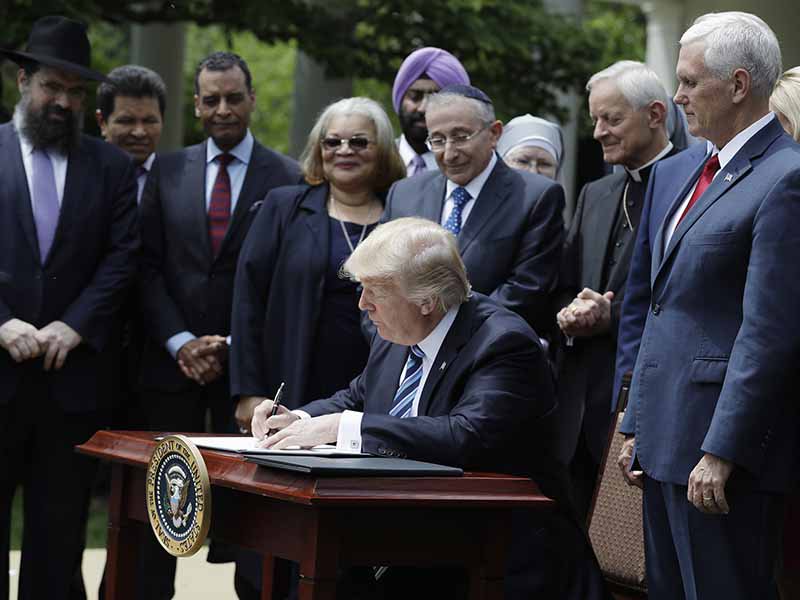

President Donald Trump signs an executive order in the Rose Garden of the White House in Washington on May 4, 2017, asking the IRS to use “maximum enforcement discretion” over the regulation known as the Johnson Amendment, which applies to churches and nonprofits. (AP/Evan Vucci)

The campaign to remove the Johnson Amendment has intensified since the election of President Trump, who promised to "totally destroy" it. The president signed an executive order addressing the issue in May 2017, later stating in an interview with conservative Christian leader Pat Robertson that he had "gotten rid" of the law. But experts — including conservative groups such as the Alliance Defending Freedom — disagreed, noting the text of the order only asks the Treasury Department to use "maximum … discretion" when enforcing the Johnson Amendment.

Despite a contention by the Johnson Amendment's foes that the rarely enforced law compromises religious freedom or liberty, removing it is deeply unpopular with people of faith.

According to a 2016 Public Religion Research Institute poll, majorities within all major U.S. religious groups oppose allowing churches to endorse candidates while retaining their tax-exempt status — including white evangelical Protestants. In addition, 99 religious groups sent a letter to Congress in April 2017 asking lawmakers to stop attempts to politicize churches, and later that year more than 4,000 faith leaders signed on to a letter demanding Congress refrain from weakening or repealing the Johnson Amendment.