Matthew Kelly speaks at a Living Every Day with Passion and Purpose event, June 1, 2015. (Wikimedia Commons/The Dynamic Catholic Institute)

Editor's note: Matthew Kelly may be one of the best-selling Catholic writers of this generation. The Ohio-based author, speaker and management consultant also founded and runs a nonprofit evangelization organization, the Dynamic Catholic Institute, and owns a number of for-profit businesses. This series examines Kelly's enterprises, as one of the most successful efforts of a growing number of entrepreneurs selling catechetical, spiritual, organizational and leadership materials to the country's 76 million Catholics. Part 1 looked at Kelly and his business interests. This is Part 2. Read Part 3 here.

Although National Catholic Reporter requested an in-person or telephone interview over the course of six weeks, Kelly agreed only to answer questions in writing. Unless otherwise noted, all quotations from him are from that email interview.

Dynamic Catholic's spacious offices in Erlanger, Kentucky, just south of Cincinnati, sit at the end of a winding road in a modern office park surrounded by several wooded acres, which means employees can watch wildlife outside the cafeteria windows. A portion of the 80,000-square-foot building is empty, set aside "for growth," a tour guide explains.

The other side includes a massive, two-story warehouse, stocked floor to ceiling with books, CDs and other materials, millions of which are sold and shipped every year to individuals and parishes as part of the organization's ministry to develop "world-class resources that inspire people to rediscover the genius of Catholicism," according to its mission statement — which is emblazoned on the lobby wall.

But Dynamic Catholic is not a publisher. That work is done by a for-profit company headed by the same man who founded and heads the nonprofit organization: Catholic author, motivational speaker and business consultant Matthew Kelly.

In fact, at least three of Kelly's numerous for-profit companies do business with the nonprofit where he is CEO: Beacon (now Wellspring) Publishing, Floyd Consulting and a limited liability company that owns the office building.

Dynamic Catholic's parish book program nets money for the nonprofit Dynamic Catholic — $1.8 million in 2017, according to board member Brian Caster. But profits that year for Kelly personally were more than double that, almost $5 million in that year, according to the book publisher's former chief operating officer.

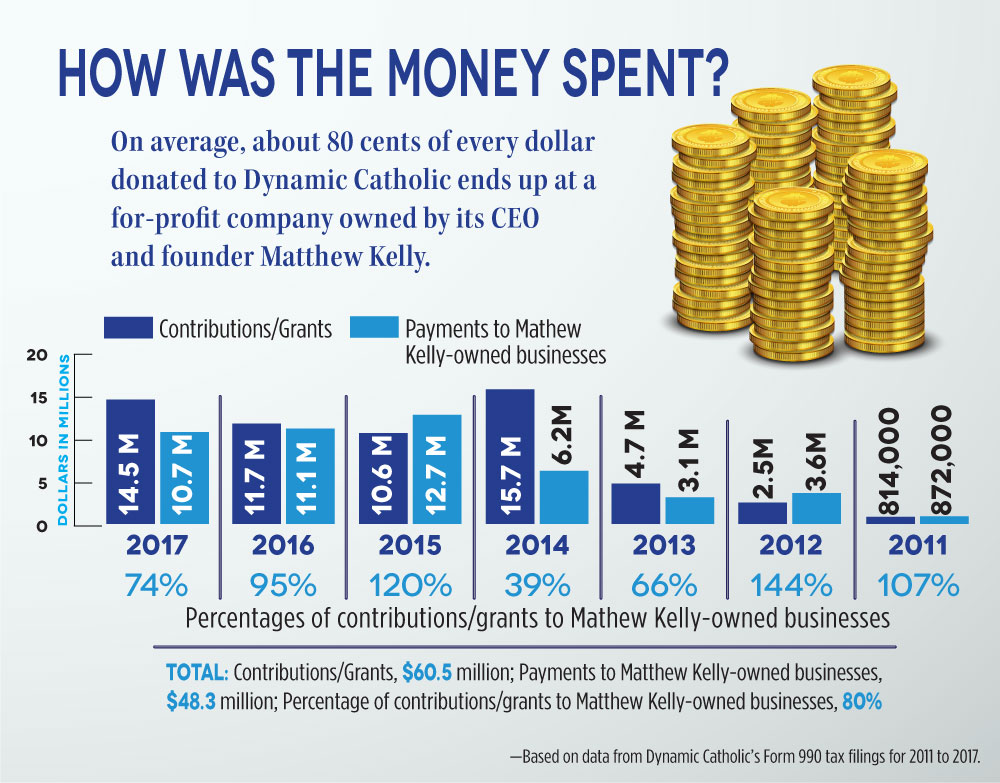

Over the years, Dynamic Catholic has provided more than $48 million to Kelly's companies, in book sales, consulting fees and rent, according to the seven years for which tax documents are available, 2011-17.

Whatever salary, if any, he has drawn directly from Dynamic Catholic since 2015 has been negligible. Tax documents show $160,000 a year from "related organizations." In addition to the three companies that do business with Dynamic Catholic, Kelly also owns and oversees a vast and complicated network of other for-profit companies, including a high-end watch company and several LLCs (limited liability corporations) that seem to be real estate holdings. Profit and salary information on these companies is not public.

Exterior of the Dynamic Catholic Institute building in Erlanger, Kentucky (NCR photo/Heidi Schlumpf)

Kelly, who learned about business from his father, defends his business practices. "I enjoy investing in real estate, stock, and various business, and I see these paths as responsible stewardship," he told NCR. "All of these have allowed me to fund incredible initiatives that have touched millions of lives. I don't want to be the guy in the Gospel who received one talent and brought back one talent."

But it is the relationship between some of Kelly's privately held for-profit companies and the Catholic nonprofit he founded that could be problematic. At least three of those companies have entered into business dealings with Dynamic Catholic in ways that experts interviewed by NCR say could have ethical or even legal implications, depending on the details.

In his defense, Caster points out that Kelly draws no salary from the nonprofit and "dedicates more than 90% of his time to Dynamic Catholic, while other people run his businesses."

"He has allowed Dynamic Catholic to use his name, his brand and significant portions of his intellectual property at no cost to Dynamic Catholic for the last decade to further our mission of re-energizing the Catholic Church in America," Caster told NCR in an email interview.

Yet, in one year alone, more than $10 million was paid from Dynamic Catholic to Kelly's privately held for-profit companies, primarily to Beacon Publishing (recently renamed Wellspring). The Florida-based publisher, owned by Kelly, sold $9.5 million in books and other inventory to Dynamic Catholic in 2017, according to tax documents from the most recent year for which data is available.

Dynamic Catholic, in turn, gave most of the books away, save for a small shipping and handling fee, while donors footed the bill in an effort to evangelize lukewarm Catholics.

Of the nonprofit's nearly $20 million in revenue in 2017, the vast majority — nearly $14.5 million — came from gifts and grants, according to tax documents. That includes, according to Caster, some tens of thousands of "ambassadors" to Dynamic Catholic, most of whom give the organization at least $10 a month. That results in at least about a quarter of a million dollars in monthly income.

But what those donors may not know is that, on average, about 80 cents of every dollar donated to Dynamic Catholic ends up at a for-profit company owned by Kelly. In some years, such as 2015, more than 100 percent of the money donated went to Kelly's businesses.

(NCR graphic/Toni-Ann Ortiz)

Book distribution

If you want to buy any of Kelly's books, you could pay full price at a bookstore or Amazon. Or there are hundreds available for resale online, for as little as 10 cents plus shipping and handling.

But you don't even have to pay that dime.

At the Dynamic Catholic website, individuals can order up to five copies of many of Kelly's books (and a few titles from other authors) for free — plus shipping and handling, which comes to less than six bucks for each copy.

Through the Parish Book Program, congregations can purchase a featured book for $2 as long as they order at least 500 copies, and only $3 for fewer than 500 copies.

The book program suggests parishes purchase enough books for 75 percent of registered families and distribute the books at Christmas and Easter as a way to evangelize irregular churchgoers. It promises to "Bring the people you love back to church. … Increase attendance. Increase giving. … Transform people. Transform your parish. … Change the world! … One book at a time," according to a promotional video.

It also potentially increases Kelly's reach and profit margin.

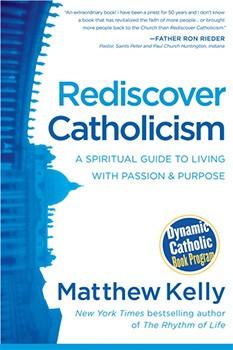

The idea to distribute books for free or low-cost came in 2002, Kelly told NCR, with the release of Rediscover Catholicism at the height of the sexual abuse scandal in the church. Despite high sales, "what became clear to me was that most of the people who could benefit from it the most were not going to walk into a bookstore and buy a copy," Kelly said.

"This is the great challenge with sharing anything spiritual," he added. "Those who need it the most don't know they need it, and people don't buy things they think they don't need."

"Rediscover Catholicism" by Matthew Kelly

Many of Kelly's books have been best-sellers, but those sales numbers have long been controversial because the majority are distributed in bulk at his speaking engagements, or, increasingly, at parishes through Dynamic Catholic.

Dynamic Catholic also offers free, or for very low cost, sacramental preparation materials, which has hurt sales for other publishers of Catholic books and materials and driven down the price of the products.

Kelly used to occupy multiple spots on the Association of Catholic Publishers "Catholic Best-Sellers" list, by claiming books given away in bulk at speaking engagements as sales. The association eventually discontinued the list, in part, some say, to prevent Kelly from dominating it, according to book publishers who spoke on condition of anonymity.

Bulk sales of books for giveaway is not illegal, but it remains controversial in determining best-seller status. Just ask Donald Trump Jr., whose Triggered in November earned an asterisk-like "dagger" from The New York Times because of bulk purchases and free distribution by the Republican National Committee.

In the case of Kelly's books, his for-profit publisher sells almost exclusively to his nonprofit, where Kelly is also CEO and makes decisions about how much donor money to use to purchase inventory from his for-profit company. Simply put, Kelly essentially has control over both the supply and demand of those transactions.

In some cases, Beacon did little work on the actual production of the books, especially the Catholic Moments catechetical materials such as “Blessed,” according to its former COO, Nathan Davis. At least one then-Dynamic Catholic employee, graphic designer Leah Nienas, is credited with designing a Beacon book, Rediscover Jesus in 2015.

Kelly said Dynamic Catholic is not involved in the editing or publishing of the books, he said, "but that may change in the future." Davis, however, said an agreement between Dynamic Catholic and Beacon signed in 2017 included the provision that Dynamic Catholic could not operate as a publisher for the next seven years beginning in 2018, even though it may be in Dynamic Catholic’s financial interests to publish the books themselves.

Beacon's books often include the Dynamic Catholic logo, which helped the nonprofit with brand awareness, Kelly said.

Beacon has been undergoing a rebranding as Wellspring, including the imprint Blue Sparrow, for several years. Kelly said Beacon has published more than 400 titles by about 50 authors, although these numbers could not be confirmed, since Beacon/Wellspring's website has been under construction for more than a year.

On its website, Dynamic Catholic insists that with the free books program, “We don’t hand out a bunch of books and hope it works. We know it works and so we hand out a bunch of books”; the organization is "only the middle man" between "God and you."

But the Parish Book Program also seems to be something of a middle man between Dynamic Catholic donors and Kelly's for-profit publishing businesses, especially Beacon Publishing.

Screenshot from the Parish Book Program promotional video on the Dynamic Catholic website (NCR photo)

Beacon has been profitable for Kelly, who has owned the company since he spun it off as a for-profit in 2001 from the nonprofit Matthew Kelly Foundation, which has since been dissolved. Before that, Kelly contracted with major publishing houses, such as HarperSanFrancisco (now HarperOne) or Ballantine, who pay authors royalties based on number of books sold.

But as owner of Beacon, Kelly is the recipient of the company's profits, which are substantial. In 2016, Beacon made about $7 million in net profit, after expenses, on about $10.5 million in sales, according to former Beacon COO Nathan Davis.

Nearly $10.2 million of that $10.5 million in Beacon's sales that year — 97 percent — were to Dynamic Catholic, according to tax documents for the nonprofit organization.

In 2017, the company made nearly $5 million, Davis told NCR.

Dynamic Catholic also makes money on the Parish Book program, some $1.8 million that year on 5 million units, Kelly said, because Beacon sells the books and materials at such a deep discount — more than 90% off the retail price.

According to Kelly, "These prices are set in accordance with a bidding process and conflict of interest policy established by Dynamic Catholic's Board and legal counsel."

Kelly also owns Dynamic Catholic's warehouse and office space in Erlanger, having purchased it in 2014 for $2.45 million through a company called Olympic Boulevard LLC. In just three years, according to tax documents, Dynamic Catholic paid the Kelly-owned company $1.1 million on in rent, as well as an additional $347,372 in rent to another Kelly-owned LLC, called Arbor Tech.

Sign for the Dynamic Catholic Institute in Erlanger, Kentucky (NCR photo/Heidi Schlumpf)

In 2017, Dynamic Catholic made rent payments of about $825,097 to Kelly-owned businesses, although the individual companies are not named on tax documents.

Caster said Dynamic Catholic's rent is "about 30% below market rates" — a move done at Kelly's request "to protect both Dynamic Catholic and himself from any sense of impropriety."

The board decided that purchasing the building itself was "not the highest and best use of donor dollars," Caster said.

Last summer, Kelly offered to donate the building to Dynamic Catholic, Caster told NCR. "But after evaluating the situation concluded that at this time Mr. Kelly's cash donations are more critical to the mission [than] owning the building," he said.

Finally, in addition to the book sales and rent, Kelly makes money from his nonprofit through business dealings with his for-profit coaching firm, Floyd Consulting. In 2017, Dynamic Catholic paid Floyd $358,438 for training services, according to tax documents. The previous year, Floyd provided $264,750 in outside consulting services to the nonprofit.

Those services were Floyd's "Dream Manager" program of "personal and professional development," which Caster said had been requested by Dynamic Catholic team members. Dynamic Catholic pays half the price of other Floyd corporate clients for the program, he said.

"It is important to note that Mr. Kelly expressed reservations about this relationship based on his recognition that many observers could view this as inappropriate," Caster told NCR. "The Board understands that reservation but believes the benefits of the Dream Manager program and its impact on employees' lives fully justify its inclusion in the team's employee benefits."

Advertisement

Red flags

The number of potential conflicts of interest raise red flags, said two attorneys contacted by NCR. Both declined to comment on the specifics of Dynamic Catholic, but noted relevant state laws that govern nonprofits and Internal Revenue Service regulations that cover tax-exempt charities.

Both state and IRS rules address conflict of interest issues that arise when a nonprofit charity does business with for-profit entities that have relationships to "insiders" in the nonprofit. Insiders can include founders, high-ranking employees or board members.

In short, the laws and regulations say that individuals may not derive a benefit from a nonprofit that is greater than what they provide to the nonprofit.

However, relationships between nonprofits and for-profits of insiders are not prohibited per se, said Alexander Campbell, an attorney with the firm of Buckingham, Doolittle & Burroughs in Cleveland, and the benefit that insiders provide may be quantified in a variety of ways.

"But they need to be handled with great caution because there are a number of potential pitfalls," said Campbell, whose practice focuses on nonprofit organizations.

When such conflicts of interest arise, Ohio law requires the individual to disclose financial interests and recuse themselves from decision-making on the issue. The organization also needs to confirm that any business exchange is at fair market value and in the best interest of the organization.

Those decisions must be made "at arm's length" by board members without a financial interest in the decision, Campbell explained.

At Dynamic Catholic, the board includes Kelly, his father-in-law Patrick Burke and Allen Hunt, who serves alongside Kelly as senior advisor at Dynamic Catholic and who is an author with Beacon. All three — representing more than half the current board — would have financial interest in a decision about Kelly's for-profit companies doing business with the nonprofit.

Other board members include real estate investment mogul Lamar Hunt Jr. and businessman Brian Caster. Merchant banker Frank Hanna abruptly resigned in the middle of his term as a board member two years ago and appears not to have been replaced.

Kelly recuses himself from "all Board activities related to any entity that he has an interest in to avoid the appearance of impropriety and any potential conflict of interest," in accordance with Dynamic Catholic's conflict of interest policy, Caster told NCR.

In addition, Kelly, his father-in-law and "any board member considered to be an 'interested party' " recuse themselves from voting on related matters, he said.

Lamar Hunt Jr. (Wikimedia Commons/Loretto Holdings LLC (CC by SA 4.0)

That would currently leave only Caster and Lamar Hunt Jr. to make those decisions.

During Dynamic Catholic's early history, the board consisted exclusively of Kelly, his wife and his father-in-law. It wasn't until 2015 that outside board members were added, including Caster, Lamar Hunt and Hanna, according to Form 990 tax documents.

An independent board is key to managing conflicts of interest, said Phil Hackney, associate professor at the University of Pittsburgh School of Law, whose teaching and research focuses on nonprofit law.

"Otherwise, even with the best of intentions, the mission can get corrupted and become a problem," he said.

Disinterested board members can help prevent violations of the IRS code that forbids charitable organizations from being used to further a for-profit business or from inuring or benefiting the private interests of an individual. Again, paying fair market value is important to avoid the former, Hackney said.

But Campbell warns that even practices that are technically legal may not be prudent for a nonprofit organization. "Technically legal doesn't mean you should do it," he said "because the perception problem may be your biggest issue."

Dynamic Catholic's board recognizes the "perceived conflict of interest" between Kelly's business interests and the nonprofit organization, Caster said, noting that it has been thoroughly examined by third-party experts and even the Attorney General of Ohio.

"It is often assumed that a conflict of interest is always a bad thing. That is not the case," Caster told NCR. "It is often more beneficial and thus preferential to have a friendly interested supplier who intimately understands and is willing to support the mission of a non-profit ministry."

The "unique funding model" between Dynamic Catholic and Beacon Publishing has been a long and mutually beneficial one, said Caster.

One longtime Catholic publisher believes Kelly is "walking on thin ice" ethically. "He has two pockets," Cullen Schippe, who spent 46 years in book publishing, said of Kelly: "He takes money out of one pocket and puts it in the other pocket."

Even if the arrangement is not "technically illegal," Schippe said, "it certainly is slick."

[Heidi Schlumpf is NCR national correspondent. Her email address is hschlumpf@ncronline.org. Follow her on Twitter @HeidiSchlumpf.]